Table of Contents

Social security card for foreign students- Sozialversicherungsnummer

In practice, anyone who starts to work in Germany generally becomes subject to social insurance contributions. This also applies to employees from abroad. However, some special regulations must be considered.

The article deals with the details about the social security ID in Germany, also known as Sozialversicherungsnummer, Versicherungsnummer, Rentenversicherungsnummer, or simply RNVR.

The Sozialversicherungsnummer Explained – Compulsory insurance for foreigners

In Germany, the social security management system is quite incredible. Every expatriate working there needs to get himself a social security unique identification issued by the statutory pension insurance fund of the state to every working as well as an unemployed expat. Let us learn more about Sozialversicherungsnummer.

The German social insurance law does not apply to foreign employees who

- have been dispatched to Germany by their employer abroad,

- are employed or self-employed in several countries,

- are subject to an exceptional agreement with another state.

Related Reading: Germany Job Seeker Visa Information And Application Process

What is a social security ID in Germany?

It is a unique set of numbers provided to every expatriate in Germany. The ID is a pension insurance number, an identification number for the German Pension Fund, also known as the Deutsche Rentenversicherung; allotted when you are covered under public health insurance.

As a social security number, the Versicherungsnummer is a common belonging if you are working in Germany. The document is allotted to every employee by his/her employers. The number is used to enroll you in the social security system of the country.

The social security card is proof that you contribute to the statutory insurance schemes of the nation, such as pension insurance or health insurance. The uniqueness of the number defines your unique identity, thereby approving you as a member of the German social security system.

How is the European Social Security Number useful?

For expats residing in Germany the Rentenversicherungsnummer, or RNVR, is a necessary document in the following scenarios-

- While claiming social security and employee benefits in an organization.

- Or while looking for a job, the employer will require your Sozialversicherungsnummer.

- Or, while drawing your pension amount, the officials will be asking for your German Social Insurance Number.

How does a Versicherungsnummer seem?

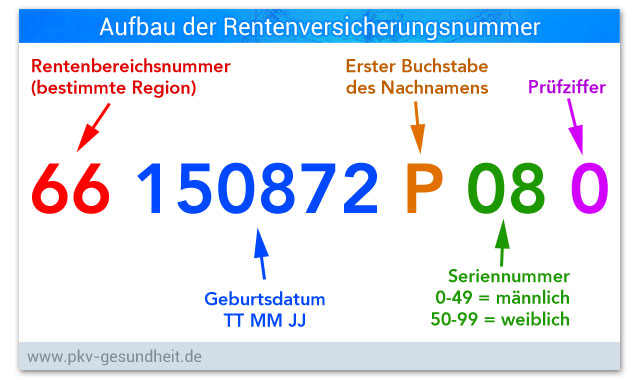

The German social security number is divided into four parts-

12 010191 A 123.

The first part represents the area code.

The second reflects your date of birth in the DDMMYY format, i.e., if you are born on 1st Jan 1991, it will be 010191.

The third part represents the initial of your last name.

The fourth is a unique set of random numbers to distinguish among people with the same name and date of birth.

How will you fetch your Social Security ID in Germany?

There are different means to get you your social security number.

1. Public Health Insurance

If you have health coverage under any of the Public health insurance schemes, you will receive a Versicherungsnummer from the health insurance company. Once received, ask for a membership confirmation document, i.e. Mitgliedsbescheinigung from the same health insurer. You will get the social security card in a matter of 2-4 weeks. The paper will contain Sozialversicherungsnummer.

The option qualifies if you need the RNVR urgently, as well.

Often in some cases, the health insurer will provide you with a temporary social security ID until you get a permanent one from your employer.

2. Employer

If you are working in Germany, the organization requires your German social insurance number to enroll you in the payroll. It will ensure to deduct a regular amount from your pay as a part of the payroll tax or the pension contribution from your paycheque. This is what social security costs.

As a newbie, once your job hunt comes to an end with a new job, the new employer will issue you your social security ID within a few weeks from your enrolment. You will receive it by post to your German registered address. If you have not received the security number in, say six weeks, you can inquire about it with your employer.

3. Previous Employer

If you do not work in Germany anymore, you can contact your previous employer and ask for your European social security number. The number can be tracked from your past tax records, thus accessible by your former tax advisor, as well.

4. From your payslip

You can find the Versicherungsnummer on your payslips too.

5. Meldebescheinigung zur Sozialversicherung or Jahresmeldung

If you work in Germany, your employer shall send you the Jahresmeldung, a document supposedly sent by every employer to each of its employees annually, somewhere in between January and February every year. The record will reflect your social security ID.

6. Private Health Insurance

For those who have private health insurance coverage, for instance, a freelancer or a self-employed individual, it isn’t easy to track your RNVR. It is possible to not have a Sozialversicherungsnummer. In such cases, it is recommended for you to contact the Deutsche Rentenversicherung. They will help you get the social security card in 2-3 months.

What if you misplace your social security ID?

If your social security document is lost, you better contact your insurer. They will further get the German State Pension Fund to replace your lost European Social Security number.

Wrap Up

Germany is well-known for its stringent social security system. If you are working in Germany, it is essential to note down the importance of this unique document. The number validates your contribution in either of the following- statutory health insurance, statutory long-term care insurance, statutory pension, statutory accident insurance, or the statutory unemployment insurance funds. I hope the article answered all your queries about the same. You can go through the FAQs to find more answers.

Related readings:

FAQs – German Social Security Number

1. Sozialversicherungsnummer: What is it?

Also known as Sozialversicherungsnummer, Versicherungsnummer, Rentenversicherungsnummer, or simply RNVR, it is a unique social security document allotted to every employee in Germany proving your contribution to the statutory insurance funds. It contains the name and pension insurance number.

2. How do I get my social security ID in Germany?

Once you find a job in Germany, the employer organization will allot your unique social security card, within around six weeks. You will receive the same by post. The ID is necessary for the employer to deduct a fixed portion from your pay as a part of the statutory pension contribution.

3. What social security costs in Germany?

A fixed amount is deducted from every German employee’s monthly salary by their respective employers as a part of the contribution to the statutory pension fund. An equal percentage of the grant is made by the employer too. The social security number is, thus, mandatory. The contribution is made directly to the insurance funds.

4. Who needs a social security number in Germany?

If you are working in Germany, you will need the social security ID, the Versicherungsnummer. For that, you are required to be registered in Germany and thus, have a registered address there. The document will be posted to your registered address. In simple words, you cannot get a social security number by staying abroad.

5. How to register for a social security number in Germany?

- As an employee, it is your employer’s responsibility to register for social security.

- As a self-employed, freelancer, business people, or as a low-income employee, you register yourself with the help of your health insurer.

- In the case of unemployed residents, you need to register with the ‘Bundesagentur für Arbeit ‘, the local employment office.

6. Benefits of the social security number in Germany?

With the help of the social security ID, you can claim the benefits of various insurance coverage, such as parental leave, healthcare, child allowances, unemployment benefits, pension, and accident insurances from the statutory pension insurance funds.

7. Types of social security in Germany

There are basically five types of statutory insurance coverage to which the social security system in Germany relates, namely-

- Pension insurance (Rentenversicherung )Health insurance (Krankenversicherung )

- Unemployment insurance (Arbeitslosenversicherung )

- Nursing care insurance (Pflegeversicherung )

- Accident insurance

8. Who has to apply for German social security?

Every person who is registered and working in Germany needs to register for a social security number. Those who are self-employed, low-wage earners, and unemployed too need to have social security identification.

9. What do I do if I have lost my social security ID?

If you lost your social security details, you could contact the health insurer who in turn will get in touch with the German state Pension Fund to retrieve a new social security number for you.